Friday, February 24, 2017

Equity Trader Alert #2017 - 40

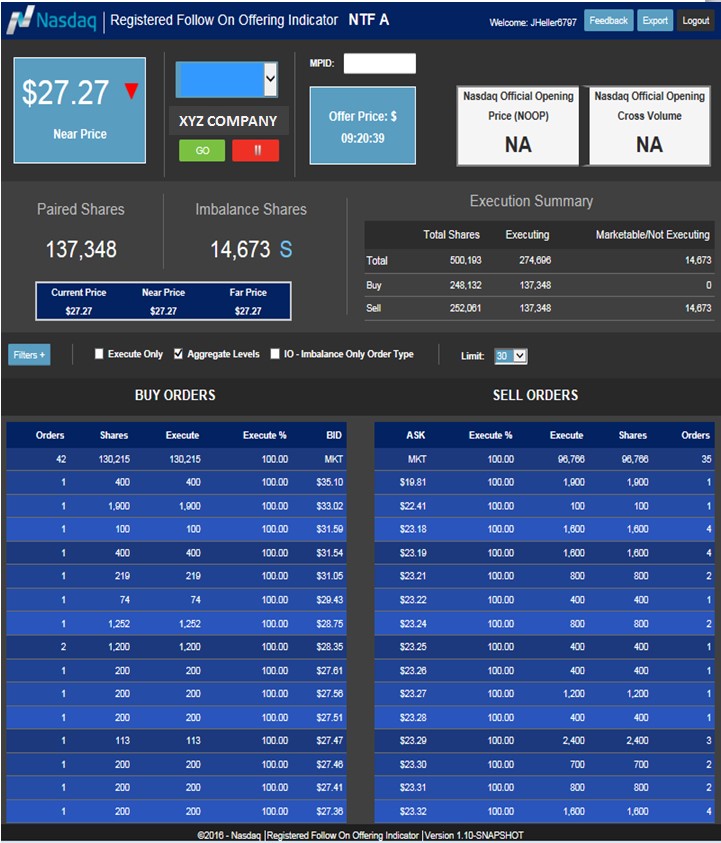

Nasdaq Introduces the RFO Indicator for Registered Follow On Offerings

Category:

Markets Impacted:Contact Information:

Resources: |

Subject to SEC approval, effective April 10, 2017, Nasdaq is pleased to introduce the new proprietary RFO Indicator tool. The RFO Indicator provides additional information to the broker-dealer serving as the Stabilization Agent during the Nasdaq Opening Cross for registered follow on offerings. This new product enhancement is part of Nasdaq’s ongoing commitment to providing issuers, broker-dealers and investors the most efficient and orderly process for capital formation events on the Nasdaq Stock Market. Product DescriptionThe RFO Indicator is available to the Stabilization Agent on the day of the registered follow on offering, and provides:

This tool will not provide a complete view of the full Nasdaq Pre-Opening Cross book.

Accessing the RFO IndicatorNasdaq IPO Workstation – The RFO Indicator can be accessed through the Nasdaq IPO Workstation. Subscribe via our online request form here. |

|---|

Please follow Nasdaq on ![]() Facebook

Facebook ![]() RSS and

RSS and

![]() Twitter.

Twitter.

Nasdaq (Nasdaq: NDAQ) is a leading global provider of trading, clearing, exchange technology, listing, information and public company services. Through its diverse portfolio of solutions, Nasdaq enables customers to plan, optimize and execute their business vision with confidence, using proven technologies that provide transparency and insight for navigating today's global capital markets. As the creator of the world's first electronic stock market, its technology powers more than 90 marketplaces in 50 countries, and 1 in 10 of the world's securities transactions. Nasdaq is home to approximately 3,900 total listings with a market value of approximately $13 trillion. To learn more, visit: business.nasdaq.com.

RSS Feeds

RSS Feeds Product Login

Product Login