Nasdaq TotalView-ITCH ("TotalView")Now available via Nasdaq Data Link APIITCH is the revolutionary Nasdaq outbound protocol |

Overview

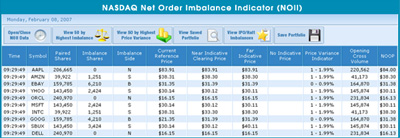

Nasdaq TotalView-ITCH — the standard Nasdaq data feed for serious traders — displays the full order book depth for Nasdaq market participants. TotalView also disseminates the Net Order Imbalance Indicator (NOII) for the Nasdaq Opening and Closing Crosses and Nasdaq IPO/Halt Cross.

TotalView Partners

Recognizing our clients’ commitment to providing their customers with the best view of the Nasdaq market available today, we’re pleased to highlight Nasdaq TotalView Partner Providers:

Bank of America*

Bloomberg Finance L.P.*

Charles Schwab & Co. Inc.

E*TRADE Securities LLC

Eze Castle Software LLC*

FactSet*

Fidelity Investments

Fidessa Corporation

MayStreet

Nomura Securities International Inc.

PTS Financial Technology LLC*

Refinitiv

TD Ameritrade Holding Corporation

Virtu Financial*

Wolverine Execution Services*

*Also offers Nasdaq Net Order Imbalance Information

Benefits & Features

|

TotalView, Nasdaq’s premier data feed, shows you every single quote and order at every price level in Nasdaq-, NYSE-, MKT- and regional-listed securities on Nasdaq.

Take advantage of opportunities others don’t know are available with TotalView by seeing more than 20 times the liquidity of Level 2 and three times the liquidity within five cents of the inside market.

|

|

TotalView also supplies the Net Order Imbalance Indicator (NOII).This indispensable tool provides invaluable information about opening and closing orders and the likely opening and closing prices of a security. This insight that can help reveal new trading opportunities as well as help you maintain your positions by more accurately gauging the true buy and sell interest in securities. NOII is the only way to gain insight into Nasdaq’s highly liquid Opening, Closing, Halt and IPO crosses.

|

|

Pricing

Please refer to the U.S. Equities Price List for pricing information.

Access Options

-

Via Nasdaq Direct Data Feed Products: Trading firms and market data vendors may create a real-time display by processing direct Nasdaq data feed products. For detailed technical documentation for Nasdaq direct products, please refer to the specifications page of the Nasdaq Trader website.

-

Via Market Data Vendors: Individual investors and traders may access real-time data through a number of authorized Nasdaq market data distributors. Market data distributors provide both display devices and data feed products containing Nasdaq real-time data. Refer to the Market Data Vendors page for a complete list of companies.

-

Via Nasdaq Web Products: For Nasdaq market participant firms, Nasdaq has incorporated TotalView depth data into its Nasdaq Workstation product. For individual and institutional investors, Nasdaq offers access to its market depth via the Nasdaq DataStore.

Agreements & Forms

To order this data on a stand-alone terminal/controlled display product, end users or end-user firms should contact their market data vendor for the appropriate agreements and forms.

To initiate this data on a data feed, firms must submit the appropriate documentation and receive prior approval from Nasdaq:

- Data Feed Request Form - Required for all firms

- Nasdaq Global Data Agreement - Required for all firms prior to initiation of the first Nasdaq data service only

- System Application - Required for firms only if the data will be displayed or used in a system that is not yet approved by Nasdaq

For the complete list of Nasdaq and UTP market data agreements and forms, please refer to the Nasdaq Global Data Products Agreements and Forms page.

How to Purchase

Firms Contact:

Individual Investors and Traders Subscribe via:

Related Products & Services

Product Support

Administrative Support

Technical Support

- Nasdaq Data Feed Specifications

- Data Center Connectivity Options:

- Nasdaq Co-Location Facility

- Nasdaq Direct Connectivity Providers

- Nasdaq Extranet Providers

RSS Feeds

RSS Feeds Product Login

Product Login