Nasdaq TradeGuard

A Comprehensive Solution for All Levels of Risk Management

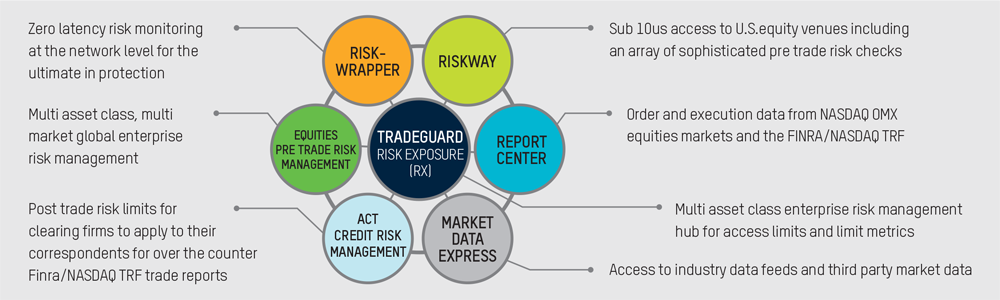

TradeGuard is a comprehensive full-service risk management suite offering a range of tools to address the complex trading landscape. TradeGuard will allow customers to pick and choose from a broad product suite for a range of support, from building a custom risk solution to simply filling in gaps in a current solution. In addition to the current enterprise and NASDAQ exchange risk tools available, the new suite also features monitoring for new markets and asset classes, improved gateways, and supplemental risk monitoring systems. Whether you’re a broker, sponsor, hedge fund, or clearing firm – TradeGuard has the products and services to meet your needs with price points that match your budget.

To learn more about how TradeGuard can help protect your business, contact Patrick Egan at +1 212 231 5733.

RiskWay

RiskWay is a sub-10µ trade control gateway for trading equities. RiskWay is tightly integrated with the TradeGuard RX risk engine to help customers trade across multiple destinations while protecting their activity with a robust set of pre-trade risk controls. With RiskWay, customers can access multiple markets with negligible latency impact and the added risk controls provided by the TradeGuard suite.

Key Benefits

- Competitive pricing

- Ultra low latency

- Integration with the TradeGuard RX risk management engine for real-time customized monitoring

- Through RiskWay, customers are able to access multiple markets and asset classes globally through a single platform

Features & Functionality

- Processing: Order book updates, risk management and message translation

- Connectivity: RiskWay supports FIX and OUCH and can be deployed in one of our data centers, at a client’s site, or third-party co-location provider

- Multiple asset classes: Coming soon, RiskWay will support all of U.S. equities and will expand into fixed income, options, and futures

Market Coverage and Asset Classes

|

PROCESSING |

Order book updates, risk management and message translation |

|

CONNECTIVITY |

RiskWay supports all exchange and trading systems and can be deployed in one of our data centers, at a client's site, or third-party co-location provider |

|

MULTIPLE ASSET CLASSES |

Coming soon, RiskWay will support all U.S equities and plans to expand into fixed income, options, and futures |

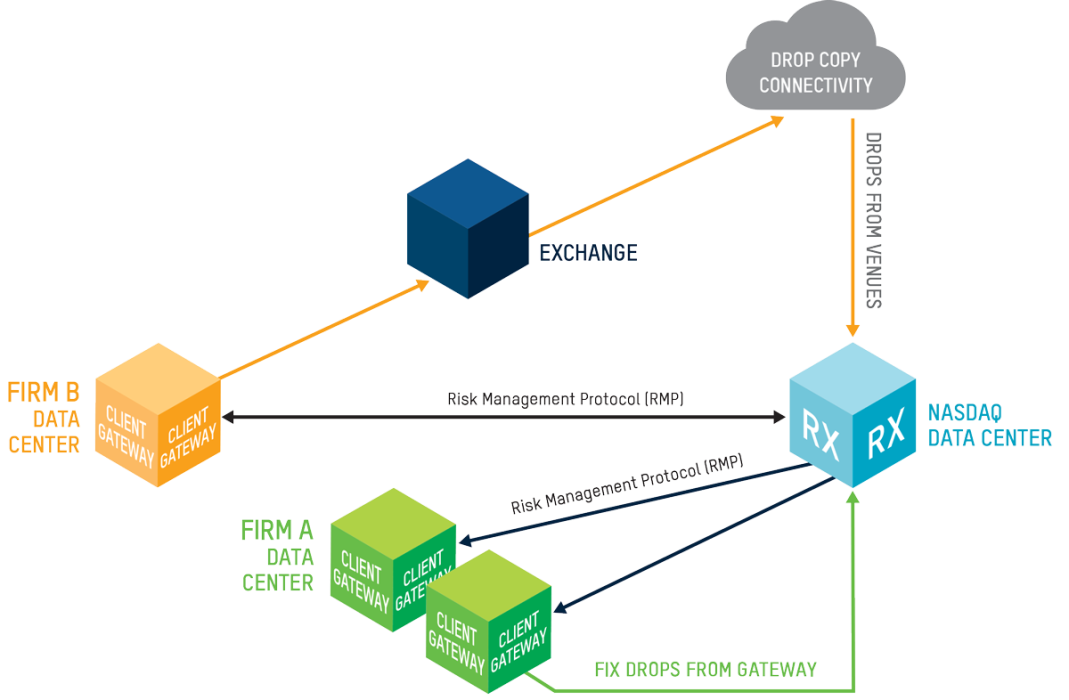

External Gateway Manager

External Gateway Manager (EGM) is an integrated solution that allows third party gateways to be controlled by the TradeGuard RX risk engine and take advantage of the pre-and post-trade risk parameters of RX. RX shows clients the current state of accounts, communicates breaches, and facilitates halts and activations of trading. EGM permits clients to benefit from RX’s controls while retaining their own gateways.

Key Benefits

- Vendor neutral, allowing you to utilize your own preferred gateway platform, while taking advantage of the protections of risk controls

- Calculates and provides current state of accounts through drop copy facilities or drops from the gateway

- Notifies breaches in client accounts via Risk Management Protocol messages (RMP)

- Easily signals the gateway to halt or activate trading from the GUI

- Messaging protocol can be used with any programming language

Features & Functionality

- EGM uses RMP with breach details in the message to inform the gateway to inhibit trading when a limit has been breached

- The EGM periodically polls the gateway for status to ensure it is responding to commands correctly

- RX can collect trade and execution reports either from trading venues or directly from the gateway

Contact Information

- Patrick Egan at +1 212 231 5733.

In The Press

Execution Gateway Solutions Fact Sheet

|

RSS Feeds

RSS Feeds Product Login

Product Login